Profit Sharing Contribution Deadline 2019

The same is true for 2019 Archer MSA contributions.

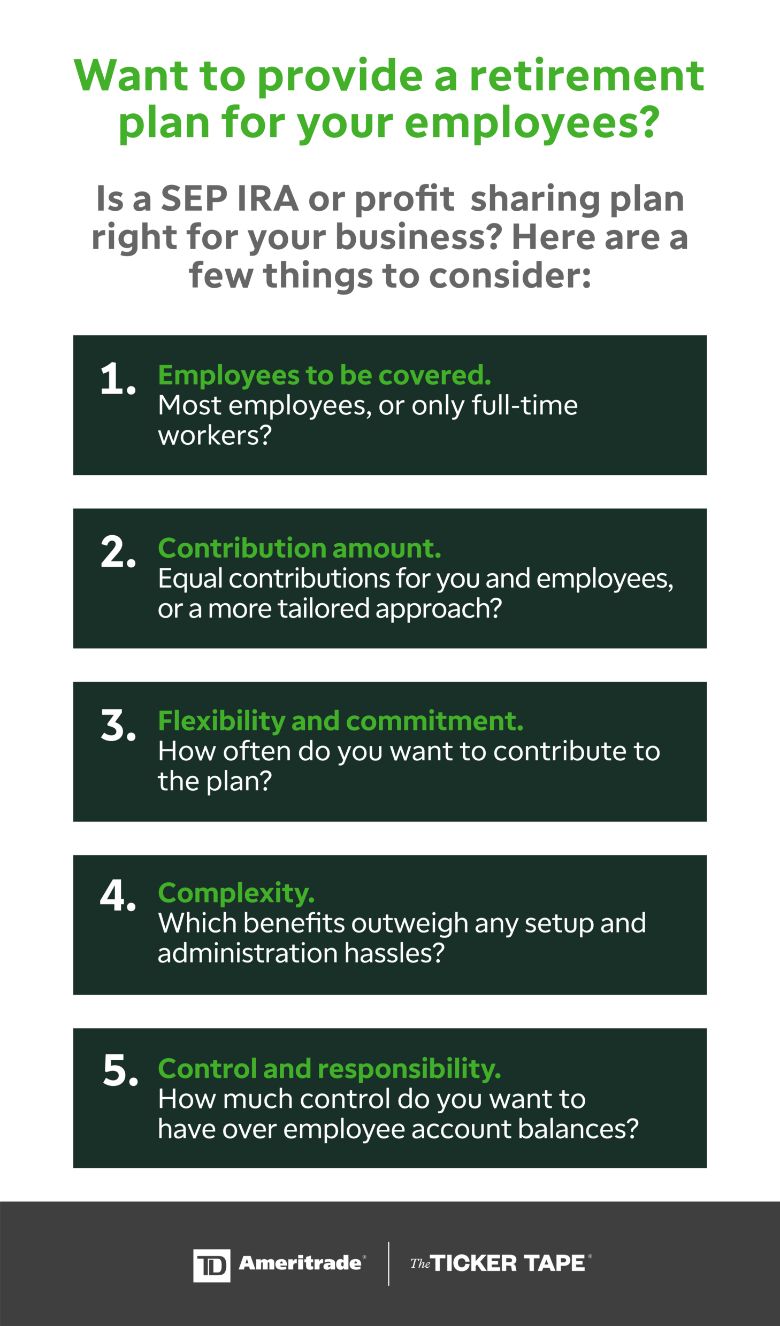

Profit sharing contribution deadline 2019. Both of these deadlines could be extended another six months until September or October 2020 by filing an extension. If your business intends to make a profit sharing contribution for the 2020 plan year you need to make the request before your business tax filing deadline. Profit SharingSimple IRA and SEP IRA Contributions with extension due September 16 2019.

For example employers with calendar tax years had to adopt the Defined Benefit Plan by December 31 2019 to receive a 2019 Plan deduction. Previously an employer had to adopt the Plan by the end of the tax year for which the deduction applied. Individual Income Tax Return with extension due October 15 2019.

If an extension is filed the deposit can be made up to September 15th. By The Human Interest Team - September 25 2019 There is a popular type of 401 k plan called profit-sharing plan. It is treated as a 2019 annual addition and is deductible in 2019 since the deposit was made in 2019.

Under a qualified Roth contribution program the amount of elective deferrals that an employee may designate as a Roth contribution is limited to the maximum amount of elective deferrals excludable from gross income for the year for 2019 19000 if under age 50 and 25000 if age 50 or over. Profit sharing contribution is made on December 15 2019 for the 2019 plan year. For a 712018 6302019 plan year.

Filing date is 1312020 Sep 15 2018 EMPLOYER CONTRIBUTION DEADLINE 401k and Profit Sharing Plans Exception entities taxed as self-employed businesses LP LLC etc can deposit employer matching and profit sharing contributions as late as October 15. Using the above example lets assume that ABC did not extend its company return and has a filing deadline of March 15 2018 but it cannot fund its profit sharing contribution until June. Because the due date for filing federal income tax returns for 2019 is now July 15 2020 HSA contributions for 2019 can be made at any time up to July 15 2020.

Yes the SECURE Act of 2019 extended the due date for adopting a Defined Benefit Plan. SEP IRA Contributions due April 15 2019. If you had an S-corp or partnership LLC the deadline was March 15 2020.