Profit Sharing Contribution Limits 2018

As of 2021 the contribution limit for a company sharing its profits with an employee is the lesser of 25 of that employees compensation or 58000.

Profit sharing contribution limits 2018. However an employers deduction for contributions to a defined contribution plan profit-sharing plan or money purchase pension plan cannot be more than 25 of the compensation paid or accrued during the year to eligible employees participating in the plan see Employer Deduction in Publication 560 Retirement Plans for Small Business SEP SIMPLE and Qualified Plans. Employee catch-up contribution if age 50 or older by year-end 6000. Its 20 in the case of a sole proprietorship or single member LLC.

Types of Profit Sharing Plans. This is an increase of 1000 from 2017. 401k Profit Sharing Contribution Limits 2018page2 - For 2020 your individual 401 k contribution limit is 19500 or 26000 if youre age 50 or older.

Current as of June 30 2018 61 5 The deferred profit sharing plan DPSP contribution limit is equal to one-half of the RPP contribution limit for the year. Please note that the information provided in the table is for the 2020 tax year. If your plan involves a profit sharing match you as the employer can contribute up to 25 of your compensation or 25 of your income if youre self-employed.

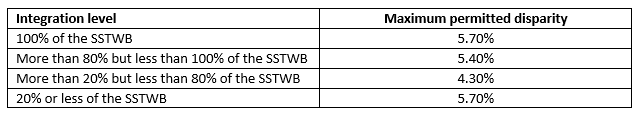

IRA Traditional and Roth IRA contribution limit 6000 6000 Catch-up limit for individuals age 50 and older 1000 1000 SIMPLE IRA Elective deferral limit 13500 13500 Catch-up limit for individuals age 50 and older 3000 3000 Maximum employer match 1 for 1 match on the fi rst 3 of employee compensation deferred. The maximum compensation eligible for plan purposes including calculation of employer or matching contributions is 290000. 6 The total of all employer contributions to a DPSP are limited to the lesser of the current years contribution limit and 18 of an employees pensionable earnings for the year.

Other years you do not need to make contributions. If you can afford to make some amount of contributions to the plan for a particular year you can do so. This includes employee deferral.

1 The amount of your compensation that can be taken into consideration when determining contributions is additionally limited. In addition the amount of an employees. The most an individual may receive from the three sources profit sharing match and 401k is 100 of compensation up to 55000 60000 if age 50.