Profit Sharing Limits 2018

The maximum annual.

Profit sharing limits 2018. The maximum annual 401 k contribution an individual can make is 18500 500 more than the 2017 limit. The maximum annual contribution to an individuals account in a defined contribution plan a money-purchase profit. 2018 Pension Contribution Limits Set for 2019 Get ready for 2019 The CRA has announced its 2019 contribution limits for Money Purchase Registered Pension Plans RPP Registered Retirement Savings Plans RRSP and Deferred Profit Sharing Plans DPSP.

Elective deferral limit 19500 19500 Catch-up limit for individuals age 50 and older 6500 6500 Profi t Sharing 401k and Money Purchase Pension Defi ned contribution limit 415c limit 57000 58000 Profi t Sharing 401k SEP and Money Purchase Pension Employee annual compensation limit 285000 290000 401k SARSEP 403b and. Please note that the information provided in the table is for the 2020 tax year. A summary of annual contribution limits for 401k 403b SEP SIMPLE money purchase and profit-sharing retirement plans.

Check with your employer for the specifics of your plan. Certain limits may vary. The contribution limits for 2018 and 2019 are as follows.

So a sole prop could actually reach a 2018 plan annual addition limit through only profit sharing with 220000 in compensation. The elective deferral limit for SIMPLE plans is 100 of compensation or 13500 in 2020 and 2021 13000 in 2019 and 12500 in 2018. There has also been an increase in the limitation for the maximum contribution total from 54000 to 55000.

For self-employed individuals who are 50 or older and make a profit of 190000 or more in 2018 the maximum annual pretax contribution is 59000. In fact combined employer and employee contributions to each participant can be up to 57000 with an additional 6500 catch-up if an employee is over age 50. This includes the employee deferral.

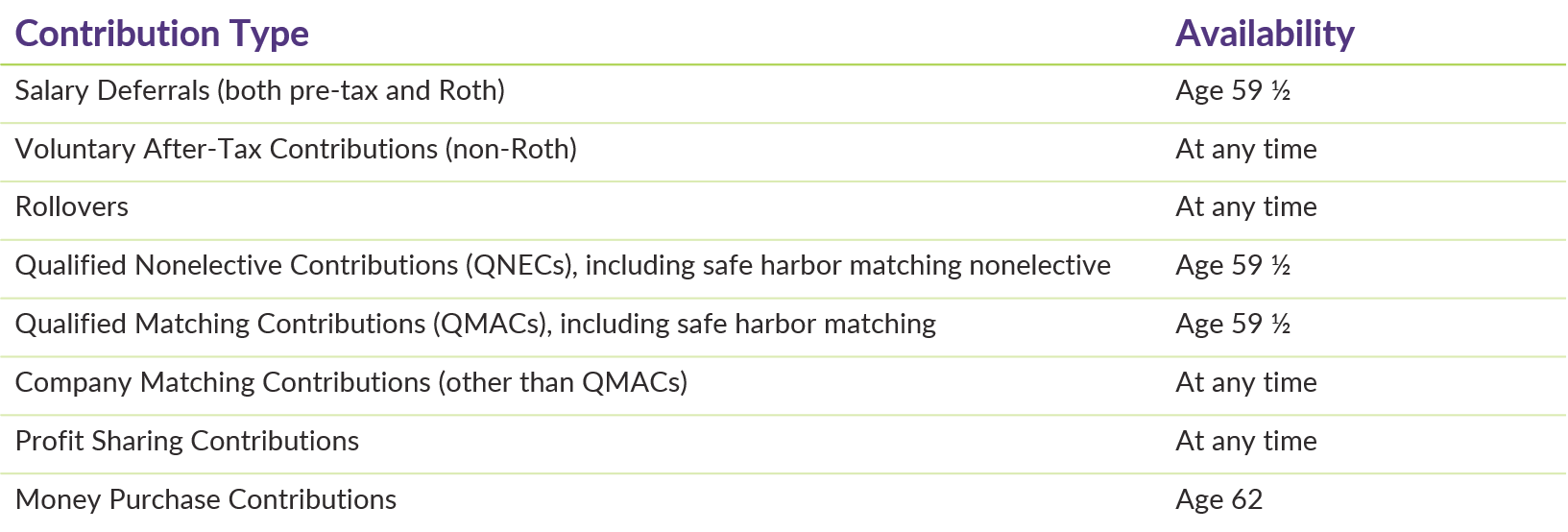

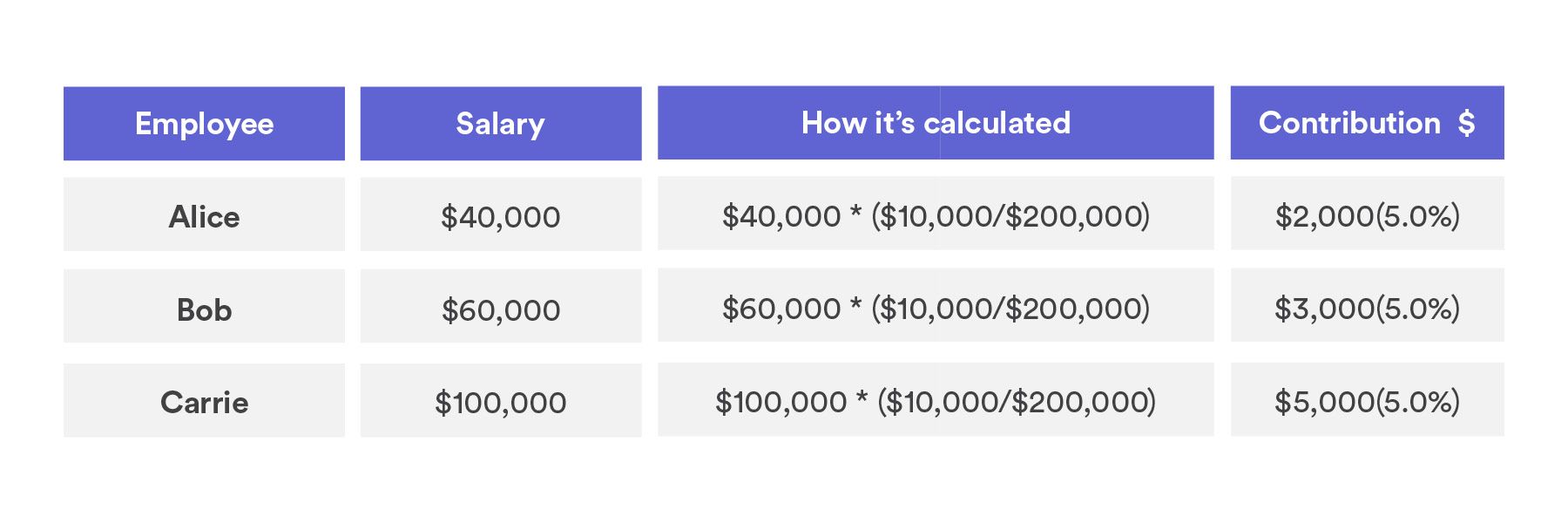

With a money-purchase plan you determine at the outset the percentage of profits to be placed in the Keogh up to 25 of your compensation. On the profit sharing side the business can make a 25 annual profit sharing contribution up to a combined maximum of 61000 an increase of 1000 from 2017. Profit sharing contributions are not counted toward the IRS annual deferral limit of 19500 in 2020.