Profit Sharing Payout Rules

The amount awarded is based on the companys earnings over a set period of time usually once a year.

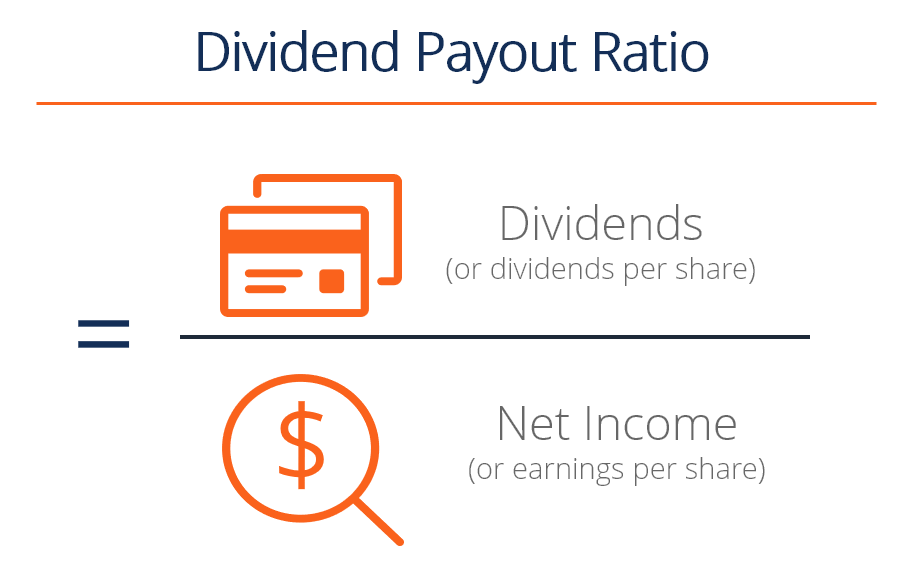

Profit sharing payout rules. Profit-sharing plans and 401 ks are both savings accounts that employers set up for their. In addition the amount of an employees. 57000 for 2020 subject to cost-of-living adjustments for later years.

Total contributions on a per-employee basis may not exceed 100 of that employees total compensation for the year. 3 When you meet. Reach age 72 age 70½ if born before July 1 1949 or retire if your plan allows this.

Profit sharing is an incentivized compensation program that awards employees a percentage of the companys profits. A cash plan is one in which the employee receives direct payment in the form of cash. In 2020 the maximum individual addition limit in a Profit Sharing Plan is 57000.

For example suppose the profits are which might be a random variable. Previously approved profit-sharing schemes resulted in tax breaks for employers which distributed profits to all staff in the form of shares worth up to 3000 per year or 10 of annual salary to a limit of 8000. For 2019 the limits on profit-sharing contributions are as follows.

In other words if the company generated only 1. 401 k profit-sharing 403 b or other defined contribution plan Generally April 1 following the later of the calendar year in which you. Going forward he also planned to use the 10 threshold to determine his profit sharing pool regardless of how much profit the company earned.

As of 2021 the contribution limit for a company sharing its profits with an employee is the lesser of 25 of that employees compensation or 58000. The profit sharing plans are based on predetermined economic sharing rules that define the split of gains between the company as a principal and the employee as an agent. With profit-sharing plans the employer may impose a vesting schedule that determines how long employees must work at a company to claim their portion of the profit-sharing money.