Profit Sharing Plan Distribution Rules

Then if you are under 59 ½ you can make a penalty-free withdrawal of up to 10000 to.

Profit sharing plan distribution rules. There is no set amount that the law requires you to contribute. The rules permits withdrawals from an employer-funded profit-sharing plan while an employee remains employed after a stated event such as. Thus required minimum distributions generally are no longer tied to a named beneficiary.

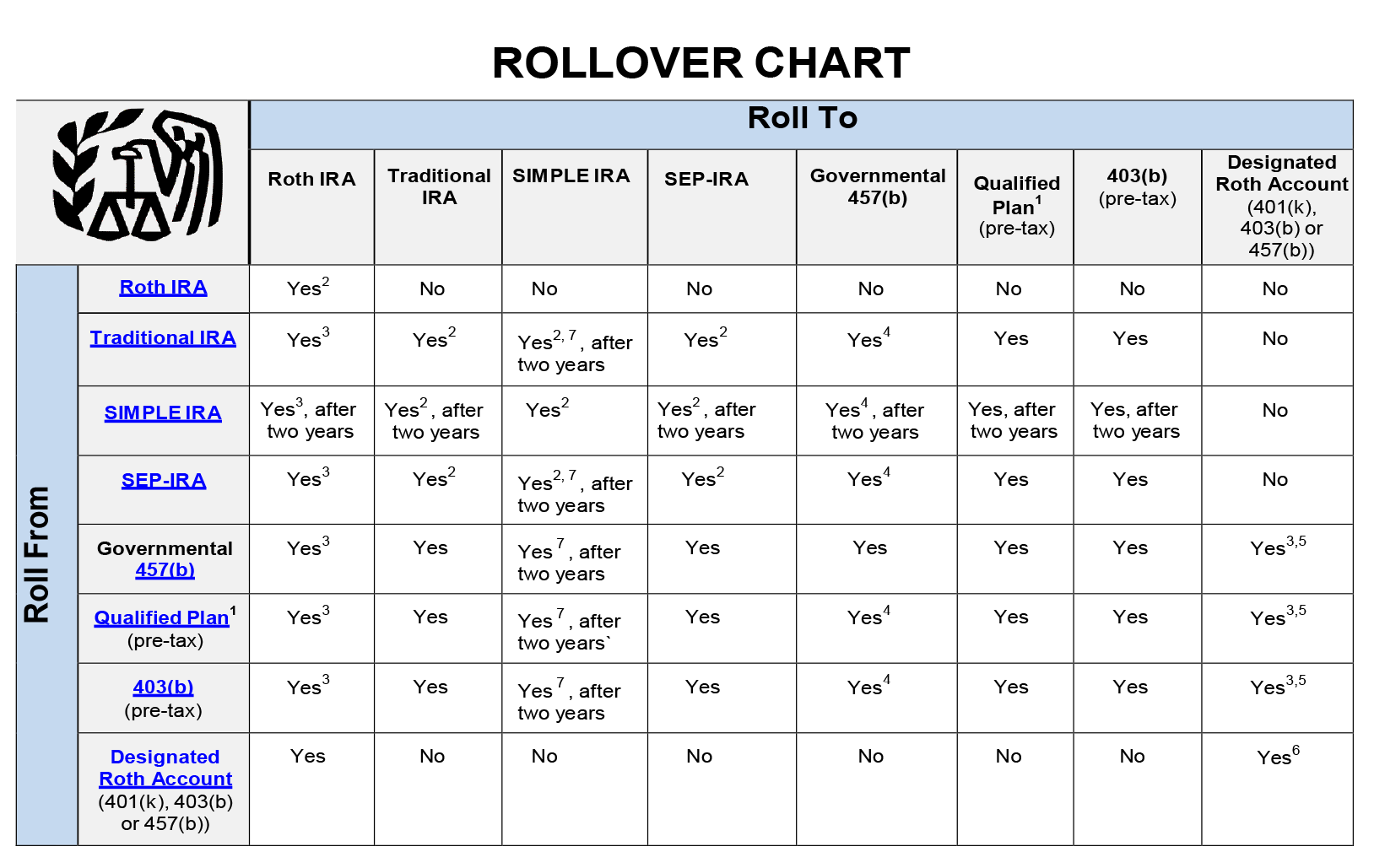

As of 2010 the maximum annual contribution is 25 percent of an employees salary or 49000 whichever is less. Contributions from the company are discretionary. The type of retirement plan such as a pension annuity IRA or 401 k The frequency of the distributions.

Employee deferrals profit sharing etc. What is the significance of age 59 ½ when it comes to in-service distributions. Employee benefits in a profit-sharing plan are subject to IRS rules designed to discourage early withdrawal.

A profit-sharing plan is a type of defined contribution plan that allows companies help their employees save for retirement. Employers can make discretionary contributions to the account of each employee on an annual basis. Other years you do not need to make contributions.

1 The employee contribution amounts are governed by the employers who must also contribute to. By Fraser Sherman Updated March 28 2017. If you can afford to make some amount of contributions to the plan for a particular year you can do so.

The rate at which federal income tax is withheld depends on. In accordance with IRS regulations minimum distributions are determined using one standard table based on the IRA ownersplan participants age and his or her account balance. Employer profit-sharing or matching contributions-- the plan may permit a distribution of your vested accrued benefit when you.