Reinvesting Profits To Avoid Tax Uk

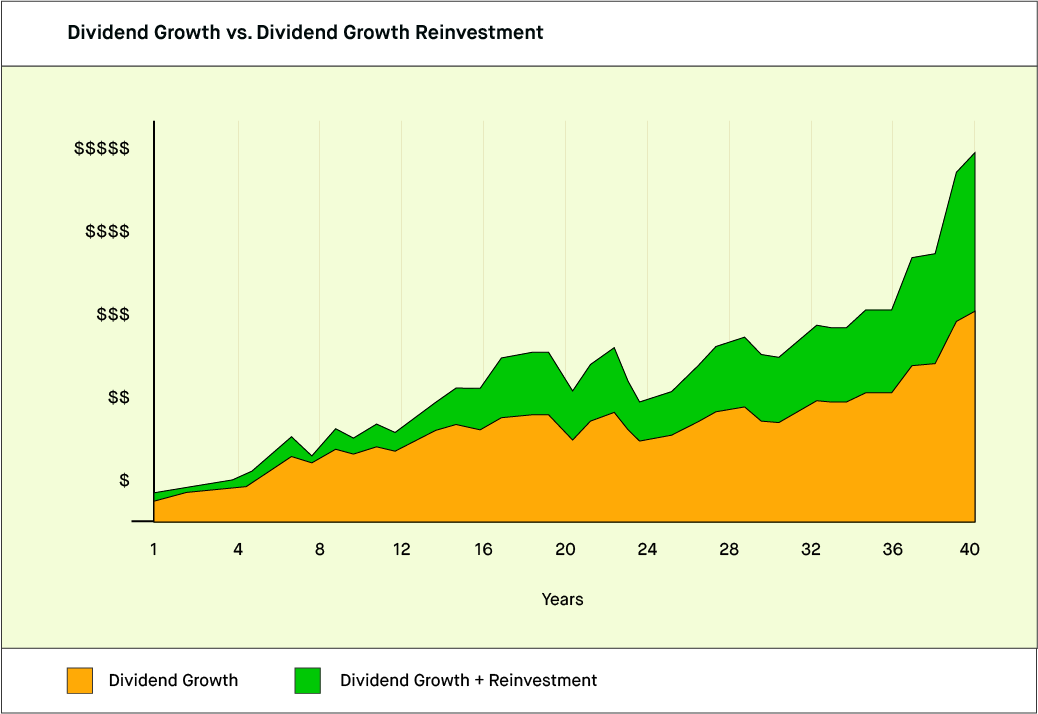

Reinvesting dividends is the process of automatically using cash dividends to purchase additional stocks of the same company.

Reinvesting profits to avoid tax uk. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of shares or other investments. Save tax with a Bed and Isa The easiest way to sidestep paying capital gains tax on your investments is to make sure they are in an Isa where any investment growth will be free from CGT and any income such as interest or dividends will be free from income tax. Whether you invest in individual shares funds or a combination of these the decision to reinvest income from your investments will of course depend on your personal circumstances.

In 2017-18 the limit was 11300 pounds. If you choose to reinvest your dividends you still have to pay taxes. 12000 for the 201920 tax year no CGT is due.

How to Reinvest Second Home Sale Proceeds to Avoid Taxes When you own a second home or investment property the Internal Revenue Service allows you to reinvest the earnings from the sale of the property so that you do not have to pay capital gains taxes. If the profit you make when selling your shares is below this amount you wont have to pay tax. Shareholders in companies listed on Londons main market received a record 1105bn in dividend payments during 2019 up 107 compared to the previous year according to latest analysis by Link Asset Services.

Youre allowed to save or invest up to 20000 in an Isa each year. In 2020-21 this is 12300 up from 12000 in 2019-20. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the 0 capital gains rate is not a.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. The tax-free allowance has also increased over the past couple of years. Astute investments in your organisations infrastructure equipment and machinery staff and training or existing assets can increase productivity and profitability as well as ensuring profits are kept in the business and not handed over to the tax man.

Capital Gains Tax CGT is a tax by the UK government on the selling assets which include property investments and shares of a listed company. With some investments you can reinvest proceeds to avoid capital gains but for stock owned in regular taxable accounts no such provision applies and youll pay capital gains taxes according to. When you come to sell your shares you could pay tax on any profits you make.