Restricted Gifts To Not For Profit Organizations

Restrictions give donors comfort that the organization they have chosen to support will use their gift as they envision.

Restricted gifts to not for profit organizations. If the donation is time restricted the funds must be used in a specified manner for a period of time. They are permanently restricted to that purpose and cannot be used for other expenses of the nonprofit. The companies codes of conduct require that all employees demonstrate the organizations commitment to treating all people and organizations with whom we come into contact or conduct business with impartially.

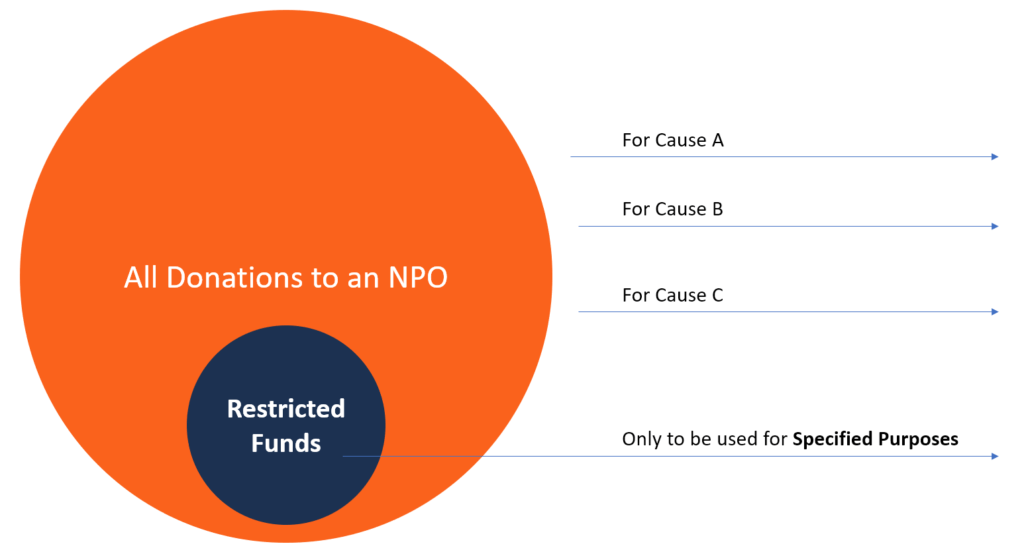

Donor restricted funds are created when gifts are received subject to donor stipulations or a binding understanding with the donor. Restricted funds are monies set aside for a particular purpose as a result of designated giving. There are 3 ways a donor can restrict a gift.

Restricted funds give donors assurance that their money is being used in the manner they desire. Often we see these restricted gifts fall into two categories. 1 For instance a donor wishes to endow a building on the campus of his alma mater in perpetuity.

Temporarily restricted funds may be either time restricted or purpose restricted. The gift can be restricted for the purpose time or endowment. C May be shown as an increase in unrestricted net assets if the restriction is met in the same period.

A restricted gift to a charity normally consists of a restricted charitable purpose trust. An example is an organization that collects gifts on behalf of a named individual. By contrast unrestricted funds may be used for any legal purpose appropriate to the organization.

Permissible restrictions include a specified purpose consistent with the charitys mission and needs a reasonable holding period and an incidental benefit to the donor. If a not-for-profit organization receives a restricted gift according to Princetonedu again it would be PERMANENTLY restricted unless the donor specifies otherwise. Funds donated to a nonprofit may be temporarily restricted.