Return On Invested Capital And Profitability Analysis

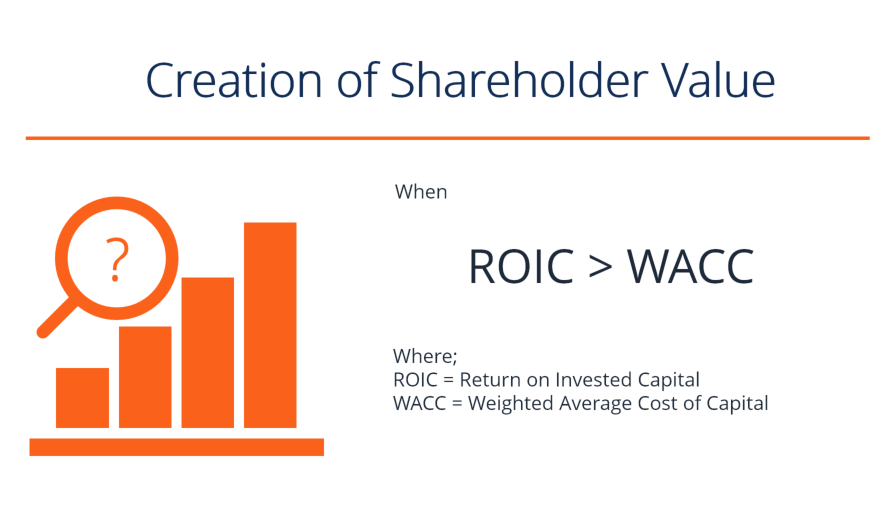

A high ROI means the investments gains compare favourably to its cost.

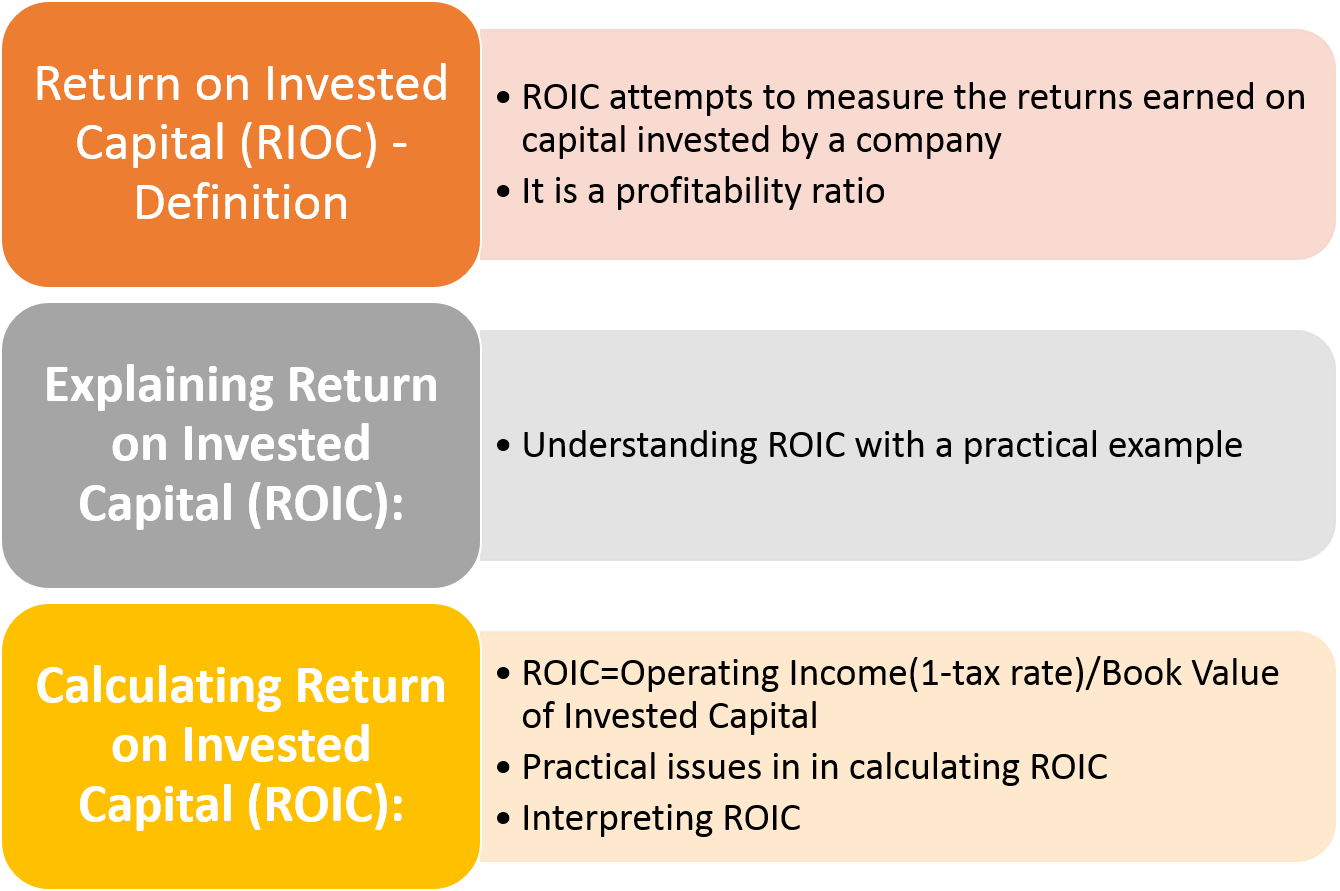

Return on invested capital and profitability analysis. Return on Invested Capital ROIC Profitability Analysis from the book by KRSubramanyam titled Financial Sta. In other words it measures a companys management performance by looking at how it uses the money shareholders and bondholders invest in the company to generate additional revenues. The first component is the use of operating income instead of net income in the numerator.

Return On Invested Capital and Profitability Analysis. ROIC PAT Invested Capital Total Equity Total Long Term Debt. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different.

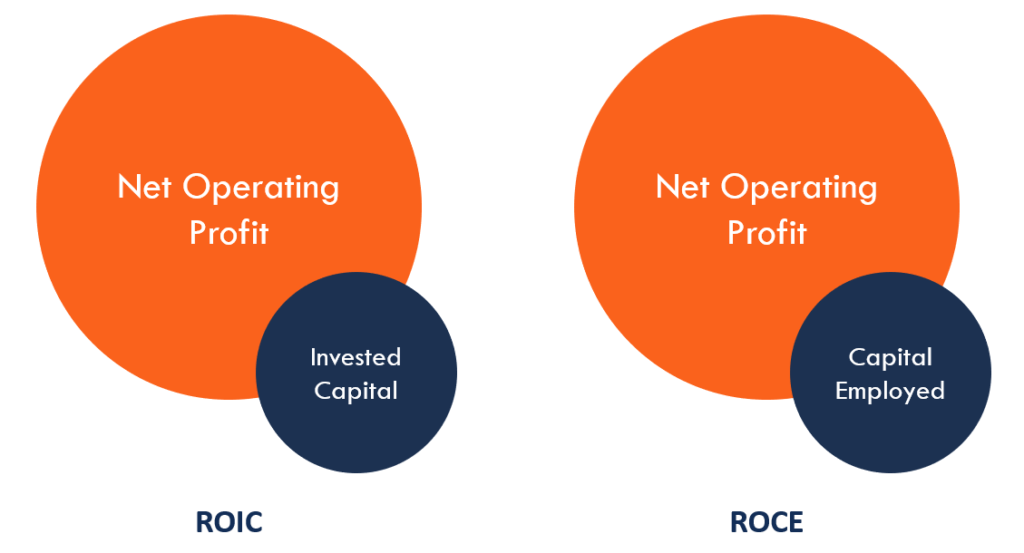

Return on Invested Capital ROIC is a profitability or performance ratio that measures how much investors are earning on the capital invested. Net Operating Profit After Taxes--NOPAT ROIC Invested Capital--IC Also known as return on capital In other words ROIC is a calculation of knowing how much cash is going out of the business to get cash. Or use Net income minus Dividends.

Return on capital employed or ROCE is a profitability ratio that measures how efficiently a company can generate profits from its capital employed by comparing net operating profit to capital employed. This video is a lecture video on Chapter 8. The ROIC is commonly presented as a percentage.

ROI is an indicator of company profitability ROI relates key summary measures profits with financing ROI conveys return on invested capital from different financing perspectives. Oleh Karena itu dibentuklah suatu alat untuk mengukur kinerja perusahaan yang menggabungkan unsur aset dan profit. The purpose of this paper is to present the manner in which the ROI Return On Investment indicator can be used in the analysis of investment projects.

Hence we consider Net Operating Profit After Tax NOPAT as a return measure in the numerator. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. Return on Invested Capital ROI Relation ROI relates income or other performance measure to a companys level and source of financing ROI allows comparisons with alternative investment opportunities Riskier investments are expected to yield a higher ROI ROI impacts a companys ability to succeed attract financing repay creditorsand reward owners.